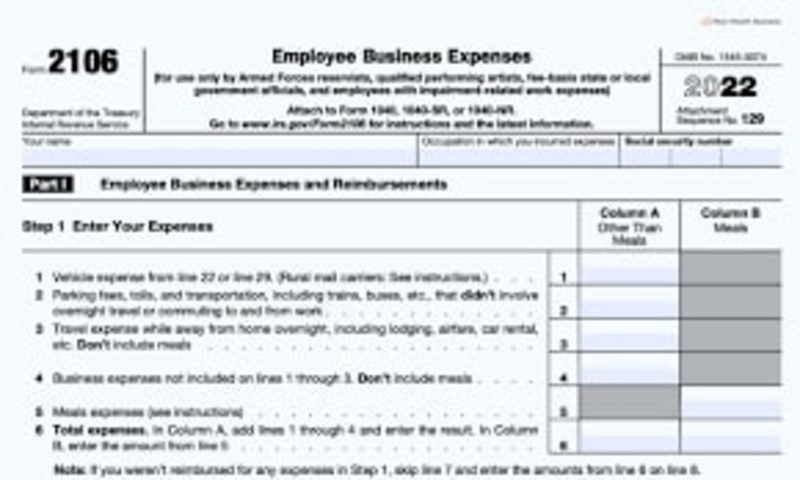

Form 2106, otherwise known as Employee Business Expenses, is a tax form utilized by United States taxpayers who are employees with deductible business expenses. The IRS (Internal Revenue Service) has designated this form, specifically for employees who have incurred expenses related to their job that are not reimbursed by their employer. This comprehensive guide aims to demystify the often complex world of Form 2106, providing clear and concise explanations about who can claim these expenses, how to calculate them, and how to correctly fill out and file the form. Whether you're a seasoned tax professional looking for a refresher or a beginner trying to navigate the complexities of tax preparation, this guide is designed to assist you in understanding and correctly utilizing Form 2106.

Who Can Use Form 2106?

Employees who have incurred expenses related to their job that are not reimbursed by their employer may be eligible to use Form 2106. This includes individuals who are employed as both full-time and part-time workers, as well as those who work for multiple employers throughout the year. However, it is important to note that self-employed individuals or independent contractors cannot use Form 2106. They must report their business expenses on a separate form, such as Schedule C.

Eligibility criteria for using Form 2106:

- Employee status: Only employees are eligible to use Form 2106. This means that self-employed individuals or independent contractors cannot use this form.

- Unreimbursed expenses: The expenses claimed on Form 2106 must be unreimbursed by the employer. If an employee receives any type of reimbursement for their business expenses, they cannot claim it on this form.

- Ordinary and necessary: The expenses must be considered ordinary and necessary for the employee's job. This means that they are common and accepted in the industry, as well as helpful or appropriate for the employee's job duties.

- Incurring expenses with a valid business purpose: The expenses must have been incurred with a valid business purpose. This means that the expenses were necessary for the employee to perform their job duties and not for personal reasons.

How to Calculate Employee Business Expenses?

Calculating employee business expenses can be a daunting task, but it is essential to ensure accuracy when filling out Form 2106. The following steps can help guide you through this process:

- Keep accurate records: It is important to keep accurate records of all business expenses throughout the year. This includes receipts, invoices, and any other documentation that supports your claims.

- Determine eligible expenses: Review the list of eligible expenses provided by the IRS to determine which ones can be claimed on Form 2106.

- Calculate total expenses: Add up all eligible business expenses for the year.

- Determine deductible amount: The deductible amount is calculated by subtracting any reimbursements received from the total expenses.

- Determine the final amount: The final amount is then calculated by multiplying the deductible amount by either 50% or 2%, depending on whether the employee is reimbursed through an accountable or non-accountable plan.

How to Fill out Form 2106?

Filling out Form 2106 can be a daunting task, but it is important to do so correctly in order to avoid any issues with the IRS. Here is a step-by-step guide on how to fill out the form:

- Start by entering your personal information, including your name, social security number, and address.

- Next, enter your occupation and employer's information.

- Indicate your filing status and the tax year for which you are filing the form.

- Calculate your total expenses and determine the deductible amount.

- Enter all eligible expenses in their respective categories on Part II of the form.

- Subtract any reimbursements received from the total expenses to calculate the final amount.

- Transfer this final amount to line 10 on Part III of the form.

- Complete the necessary calculations on lines 11-14 to determine your adjusted gross income (AGI).

- Sign and date the form, and include any additional attachments or explanations if needed.

What Expenses Can Be Claimed on Form 2106?

There are various types of business expenses that can be claimed on Form 2106, including:

- Business travel expenses: This includes airfare, hotel stays, meals, and other necessary expenses incurred while traveling for work.

- Business entertainment expenses: These are costs incurred while entertaining clients or potential business partners, such as meals or event tickets.

- Vehicle expenses: If an employee uses their personal vehicle for business purposes, they may claim mileage and other related expenses on Form 2106.

- Home office expenses: Employees who have a designated home office for their job may be able to claim a portion of their rent, utilities, and other home-related expenses on this form.

- Professional development expenses: This includes any costs related to job-related education, such as tuition or course materials.

It is important to note that these are just a few examples of eligible business expenses. It is always best to consult with a tax professional or refer to the IRS guidelines for a complete list. Additionally, it is crucial to keep accurate records and documentation for all expenses claimed on Form 2106. Failure to do so could result in issues with the IRS and potential penalties.

Conclusion

Form 2106 can be a valuable tool for employees who incur unreimbursed business expenses. However, it is essential to ensure eligibility and accurately calculate and report these expenses. By following the guidelines provided by the IRS and consulting with a tax professional if needed, employees can successfully utilize Form 2106 to claim their eligible business expenses and potentially receive a deduction on their taxes. Remember to keep accurate records and documentation for all expenses claimed on this form, and always fill it out correctly to avoid any issues with the IRS. With proper utilization, Form 2106 can provide a valuable tax benefit for employees.